By Charles H. Green

The Federal Reserve Board’s Open Market Committee meets Wednesday and Thursday this week, and the world’s eyes will be focused on the results: will they finally raise interest rates after two years of openly toying with the idea? I believe it’s high time to act decisively.

The FOMC faces a narrowing window of opportunities to fulfill their pledge to raise the  fed funds rate this year. As defined in their monetary policy announcement in July, it all comes down to two criteria: 1) some further improvement in the labor market, and 2) reasonable confidence that inflation would move back to its two percent objective over the medium term. There were no other criteria mentioned, including international events, Chinese exchange rates, the Dow Jones Industrial Average (DJIA) or who wins the first Republican presidential debate.

fed funds rate this year. As defined in their monetary policy announcement in July, it all comes down to two criteria: 1) some further improvement in the labor market, and 2) reasonable confidence that inflation would move back to its two percent objective over the medium term. There were no other criteria mentioned, including international events, Chinese exchange rates, the Dow Jones Industrial Average (DJIA) or who wins the first Republican presidential debate.

Fed chair Janet L. Yellen has said that the Fed wants to raise its benchmark rate slowly over the next several years, gradually reducing its long-running stimulus campaign to bring the economy back to good health. The Fed has held short-term rates near zero since December, 2008.

The Fed has repeatedly delayed the beginning of that process, as economic growth has fallen short of its expectations. But as recently as June, most members of the Fed’s leadership — 15 of the 17 senior officials — indicated they planned to start raising rates this year.

The Fed Doesn’t Blink

The mid-August drama in China, which has seen its primary stock index drop significantly this year despite several overt strategies designed to buffet the fall, left investors shivering around the globe. The DJIA closed Friday at 16,433, climbing back about 800 points from its August plunge. Coupled with the devaluation of the Chinese Renminbi, many analysts have predicted that rate hikes will be pushed further down the road, possibly into 2016.

And in fact, William C. Dudley, the influential president of the Federal Reserve Bank of New York, said at a late August news conference that the case for raising interest rates had become “less compelling” in recent weeks. But as reported by the NY Times, even as Mr. Dudley suggested that a September rate increase was less likely, he cautioned against assuming the Fed would significantly alter its plans. He dismissed the possibility of a new round of stimulus.

“It’s important not to overreact to short-term market developments because it’s unclear whether this will just be a temporary adjustment or something more persistent that will have implications for the U.S. growth and inflation outlook,” Mr. Dudley said.

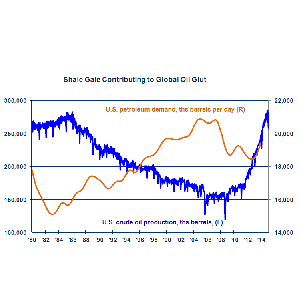

The following week Dennis P. Lockhart, president of the Federal Reserve Bank of Atlanta, in a calming speech delivered in Berkeley, CA said “I expect the normalization of monetary policy — that is, interest rates — to begin sometime this year.” Mr. Lockhart noted some of the factors that are roiling markets, including the rise of the dollar, China’s currency devaluation and falling oil prices. But he said the Atlanta Fed expected the economy to continue its expansion, including adding jobs.

Some Voices Defend Holding Rates Down

The volatility of financial markets over the last few weeks contrasts with the stability of domestic economic growth over the last several years. The Fed is focused on that broader picture, and while the pace of growth remains sluggish by past standards, central bank officials have suggested repeatedly that they regard it as good enough.

But there are still plenty of voices arguing against a rate hike. In an opinion published in the Financial Times, former treasury secretary Lawrence Summers pushed back hard.

Said Summers, “Why, then, do so many believe that a rate increase is necessary? Pressure comes from a sense that the economy has substantially normalized during six years of recovery, and so the extraordinary stimulus of zero interest rates should be withdrawn.”

“Whatever merit this view had a few years ago, it is much less plausible as we approach the seventh anniversary of the collapse of Lehman Brothers. It is no longer easy to think of economic conditions that can plausibly be seen as temporary headwinds. Fiscal drag is over. Banks are well capitalized. Corporations are flush with cash. Household balance sheets are substantially repaired,” he continued.

“Much more plausible is the view that, for reasons rooted in technological and demographic change and reinforced by greater regulation of the financial sector, the global economy has difficulty generating demand for all that can be produced. This is the “secular stagnation” diagnosis, or the very similar idea that Ben Bernanke, former Fed chairman, has urged of a “savings glut,” he continued.

His conclusion: “Satisfactory growth, if it can be achieved, requires very low interest rates that historically we have only seen during economic crises. This is why long term bond markets are telling us that real interest rates are expected to be close to zero in the industrialized world over the next decade.”

Some Argue for Higher Rates

For what it’s worth, the International Monetary Fund has also expressed concern that the Fed, by raising rates, could increase pressure on developing economies. But on the proverbial other hand, others argue that demonstrated growth justifies a return to normalized rates.

For all the zigs and zags of economic data over the last couple of years, the underlying growth rate has not deviated much from about 2.5 to 3 percent annually, according to Nariman Behravesh, chief economist at IHS, a private research and forecasting firm, as quoted in the NY Times. “Historically, this is a modest growth rate,” he said, explaining that the American economy now faces what he termed “speed limits,” including the retirement of the baby boomers, slower population growth and weak productivity gains recently.

“Would we like to see faster growth? Of course,” said Mr. Behravesh. “But we’re growing twice as fast as Europe and three to four times as fast as Japan. For a mature economy, this is about as fast as we can grow, and it’s something we can feel good about.”

The most forceful voice pressing for a rate hike comes through a NY Times opinion by business writer William D. Cohan. In his words, “Yes, it would be a little painful to start having to pay a little more for short-term borrowing and, yes, the net worth of Wall Street billionaires might increase at a slightly lower rate, but it looks as if the moment is at hand to end the morphine drip.”

“The case for raising rates is straightforward: Like any commodity, the price of borrowing money — interest rates — should be determined by supply and demand, not by manipulation by a market behemoth. Essentially, the clever Q.E. program caused a widespread mispricing of risk, deluding investors into underestimating the risk of various financial assets they were buying,” he continues.

His conclusion: “The only way to return the assessment of risk to something resembling normalcy is to stop the manipulation. That requires nothing less than serious intestinal fortitude from the Fed and a willingness to raise interest rates in the face of determined opposition from Wall Street.”

Commercial Lenders Hang in the Middle

If you aren’t on Wall Street, but sitting in a Main Street bank trying to maintain a healthy loan portfolio, the interest rate discussion carries much different implications. First of all, it’s about income. The zero-rate policies have kept the Prime Rate–the predominate interest index used by community banks–stuck at 3.25% since 2008. That has restricted a lot of revenue that could have helped recover from the crash easier, and generated better profits and compensation.

While the surviving banks have mostly recovered, today they’re sitting on loan portfolios that are priced well below plenty of the underlying risk that they represent. As rates rise, a new element of risk will enter many of these assets and could tip some borderline deals over into default. Another immediate impact will be the tightening of loan qualifications, as the price of debt rises, so will the capacity required to repay it in anyone’s financial analysis.

But all that said, I personally think that higher rates will be beneficial to the greater economy. Upward pressure on inflation would stimulate more growth than putting easy money into the hands of many borrowers with marginal capacity to borrow. This condition can prove disastrous as eventual rising rates exposes their weaknesses.

Pushing inflation higher will spur people to act sooner to buy major purchases like cars and houses, and provide a more reasonable return on risk for main street banks. It may even push some wages higher and create more competition for talent, which will benefit plenty of business developers.

What about Wall Street? They’ve had multiple “taper tantrums” and have made plenty–PLENTY–of money over the long ride of next-to-free cash. Maybe taking the DJIA back down to where the price of equity more soberly reflects the actual value of the underlying companies would be a good thing.

What do you think?

Did you know SBFI offers commercial lender training–learn more here.

Read more stories of interest to commercial lenders here.

What do you think about this story? Comment below or write me at .