Thanks for your interest in the 2015 Commercial Real Estate Lending Outlook Survey, which measured the level of confidence for growth and expansion among some of the most important participants in the supply line for delivery of business capital—mortgage professionals and CRE lenders. Please review the results below.

Rania Efthemes, Editor

Charles H. Green

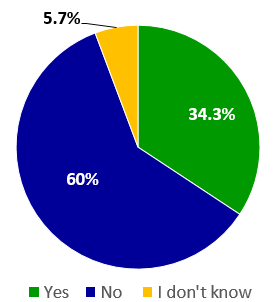

1. Were you satisfied with the funded-loan dollar volume that you were involved with during 2014?

- Yes

34.3% - No

60% - Don’t Know

5.7%

2. Were you satisfied with the number of funded clients that you were involved with during 2014?

- Yes

31.4% - No

61.4% - Don’t Know

7.2%

3. Were you satisfied with the ratio of funded loans as a percentage of loan applications that you were involved with during 2014 (loan/applicant ratio)?

- Yes

31.4% - No

60% - Don’t Know

8.6%

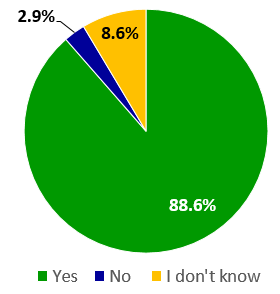

4. Do you expect to increase the funded-loan dollar volume that you will be involved with during 2015?

- Yes

88.5% - No

2.9% - Don’t Know

8.6%

5. Do you expect to increase the number of funded clients you will be involved with during 2015?

- Yes

90% - No

4.3% - Don’t Know

5.7%

6. Do you expect to increase the ratio of funded loans as a percentage of loan applications you will be involved with during 2015 (loan/applicant ratio)?

- Yes

81.4% - No

7.2% - Don’t Know

11.4%

7. Are you satisfied with the degree of property-value recovery achieved since 2009?

- Yes

55.7% - No

34.3% - Don’t Know

10%

8. Do you expect the U.S. economy to grow in 2015?

- Yes

67.1% - No

22.9% - Don’t Know

10%

9. Does your company plan to hire more people to facilitate CRE business loans in 2015?

- Yes

42.9% - No

37.1% - Don’t Know

20%

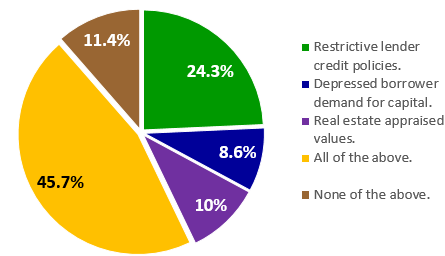

10. What do you expect will be the most significant barrier to funding CRE loans in 2015?

A. Restrictive lender credit policies – 24.3%

B. Depressed borrower demand for capital – 8.6%

C. Real estate appraised value – 10%

D. All of the above – 45.7%

E. None of the above –11.4%