Thanks for your interest in the 2016 SBA Lending Outlook Survey, which measured the confidence for growth and expansion among some of the most important participants in the supply chain for small business capital—SBA Lenders.

Please check our site monthly for the latest analysis of SBA monthly loan approval rates and YTD loan approval performance.

Here are the results of our 2016 SBA Lending Outlook Survey:

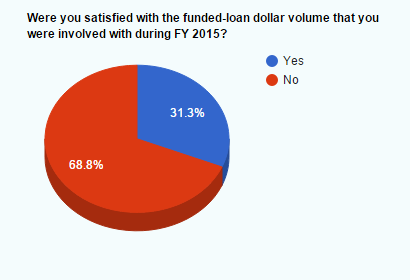

1. Were you satisfied with the funded loan dollar volume that you were involved with during FY 2015?

Yes No Don’t Know

31% 69% 0%

2. Were you satisfied with the number of funded clients that you were involved with during FY 2015?

Yes No Don’t Know

31% 69% 0%

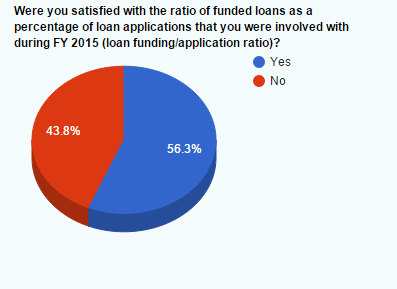

3. Were you satisfied with the ratio of funded loans as a percentage of loan applications that you were involved with during FY 2015 (loan/applicant ratio)?

Yes No Don’t Know

56% 44% 0%

4. Do you expect to increase the funded loan dollar volume that you will be involved with during FY 2016?

Yes No Don’t Know

100% 0% 0%

5. Do you expect to increase the number of funded clients you will be involved with during FY 2016?

Yes No Don’t Know

100% 0% 0%

6. Do you expect to increase the ratio of funded loans as a percentage of loan applications you will be involved with during FY 2016 (loan/applicant ratio)?

Yes No Don’t Know

69% 19% 12%

7. Are you satisfied with the degree of support and promotion of small business lending provided by the SBA?

Yes No Don’t Know

56% 38% 6%

8. Do you expect the U.S. economy to expand during FY 2016?

Yes No Don’t Know

69% 25% 6%

9. Does your company plan to hire more people to facilitate small business loans in 2016?

Yes No Don’t Know

73% 20% 7%

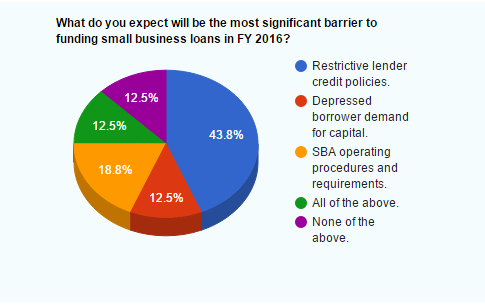

10. What do you expect will be the most significant barrier to funding small business loans in FY 2016?

Restrictive Policies Depressed Demand SBA Procedures

44% 13% 19%

All of the Above None of the Above

12% 12%

11. What conditions, terms or incentives could motivate business owners to acquire capital with SBA loans in 2016?

Extend Fee Waiver <$150k Reinstate 504 Refinance Relax Credit Standards

13% 31% 38%

Relax SBA Reqs. Other

13% 5%

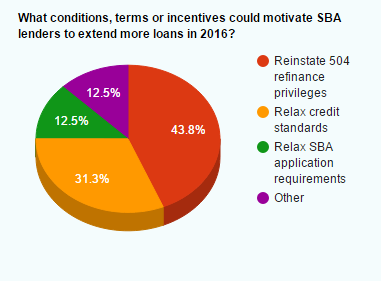

12. What conditions, terms or incentives could motivate SBA lenders to extend more loans in 2016?

Extend Fee Waiver <$150k Reinstate 504 Refinance Relax Credit Standards

0% 44% 31%

Relax SBA Reqs. Other

13% 12%

13. How would you describe your present competition for new loan business?

Lax Keeps me working Very competitive Crazy

0% 13% 80% 7%

Did you know SBFI offers commercial lender training–learn more here.

Read more stories of interest to commercial lenders–subscribe to AdviceOnLoan here.

What do you think? Your comments are welcome or write me @ .

Follow SBFI on social media: LinkedIn Facebook Twitter