The graphs on this page offer some analytics of SBA loans approved under both the 7(a) guaranty and CDC/504 program that were identified as involving business owners who are situated in rural areas. Results of these loans have been made public by SBA since FY 2009, and SBFI will update these statistics annually.

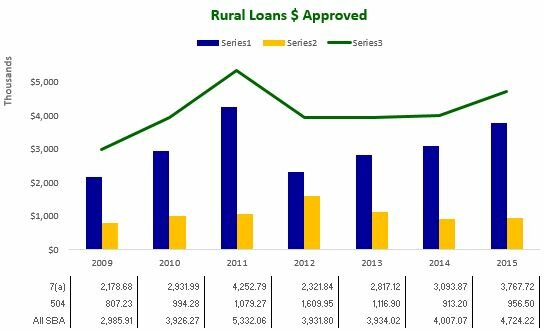

Rural Loans $ Approved

The first graph illustrates the total $ volume of loans approved for rural businesses through the 7(a) and CDC/504 loan programs respectively, with the total level of SBA program loans highlighted with the green line.

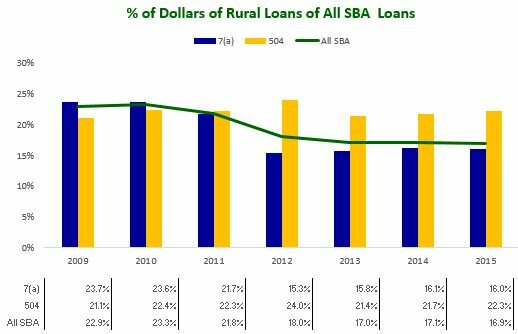

The second graph compares the total $ volume of loans approved for rural businesses as a percentage of total 7(a) loans and CDC/504 loans respectively, and as a percentage of the total SBA loan program volume.

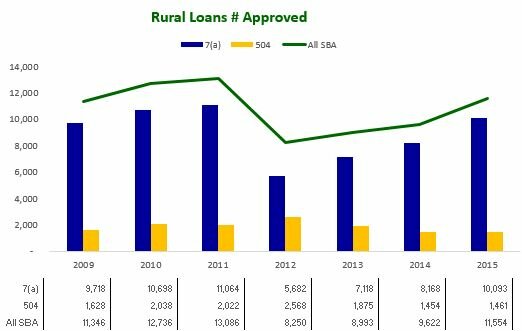

Number of Rural Loans Approved

The third graph illustrates the total number of loans approved for rural businesses by the 7(a) and CDC/504 loan programs respectively, with the total level of SBA program loans highlighted with the green line.

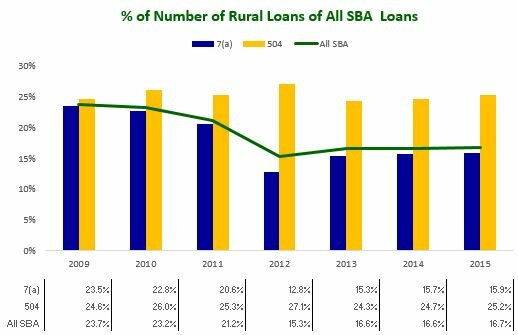

The fourth graph compares the total number of loans approved for rural businesses as a percentage of total 7(a) loans and CDC/504 loans respectively, and as a percentage of total SBA loan program volume.

SBFI tracks a range of business lending results and lender performance through published statistics and lender surveys. Finance programs facilitated by the U.S. Small Business Administration offer several financing assistance programs to small business concerns for a variety of purposes.

For more information contact .

I have received a default on my SBA loan. When they put a judgement on my loan I was up to date. I fell behind again and never received any late notice. We have a few home owners on my road that also have SBA loans! I did receive a letter saying my loan was defaulted and that I needed to come up with full amount owed! I called to talk about a way to catch up on my note and was told I could reapply due process was told I had 90 days and before my 90 days was up I was in default!! I knew I’m wrong for falling behind but I would do anything to keep my loan from default. Don’t know where to go from here can’t loose my home. I’ve been disable for 5 years and I have worked very hard to try to stay in my home. Is there any advise you can give me?

Thanks

Melinda Bandeau