The graphs on this page offer some alternative analytics of the 7(a) loan guaranty program results to provide participating lenders with a deeper understanding of what’s behind the numbers published by SBA.

The SBA provides monthly and annual approval statistics for the 7(a) loan program broken into total program $ volume and the number of debentures approved as well as how these totals break out in various demographic categories. In addition, the volume of loans approved for less than $150,000 is published.

Missing from SBA’s regular report is a calculation of value reflecting the sum of program loans approved in excess of $150,000. The graph below compares the volume of 7(a) loans less than $150,000 and 7(a) loans in excess of $150,000, with the total sum of 7(a) program loans reflected as well. These statistics illuminate the financial impact of the 7(a) program to two distinct markets of small business concerns that benefit from SBA assistance.

7(a) Loans $ Approved

Number of 7(a) Loans Approved

The second graph compares the total number of transactions between 7(a) loans less than $150,000 and 7(a) loans in excess of $150,000, with the total sum of 7(a) program loans reflected as well.

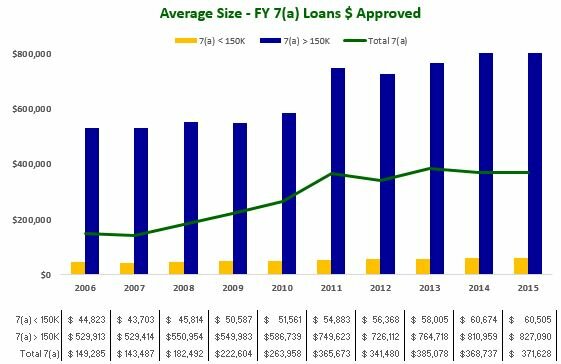

Average Size 7(a) Loans Approved

The third graph compares the average transaction size between 7(a) loans less than $150,000 and 7(a) loans in excess of $150,000, with the total sum of 7(a) program loans reflected as well.

There is broad community support for the 7(a) program, but among these supporters are also a division of interests. Many favor the effective credit insurance component of the 7(a) program that provides the banking industry with incentives to lend to small business concerns. These companies are arguably among their highest risk clients, so the 7(a) guaranty lowers their loan loss exposure. This credit is vital to support economic growth and encourages job creation and wealth development.

But other supporters are more interested in the micro portion of the small business sector, and work hard to ensure access to capital to smaller, often start-up companies, which frequently help individuals transition from full time employment into their own enterprise. These supporters are more focused on loans under $150,000.

SBFI tracks a range of business lending results and lender performance through published statistics and lender surveys. Finance programs facilitated by the U.S. Small Business Administration offer several financing assistance programs to small business concerns for a variety of purposes.

For more information contact .

Run those numbers removing SBA guarantees on credit cards and the numbers for actual business loans will look much different.