2014 CRE Lending Outlook Survey

Thanks for your interest in the 2014 Commercial Real Estate Lending Outlook Survey, which measured the level of confidence for growth and expansion among some of the most important participants in the supply line for delivery of business capital—mortgage professionals and CRE lenders. Please review the results below.

Rania Oteify, Editor

Charles H. Green

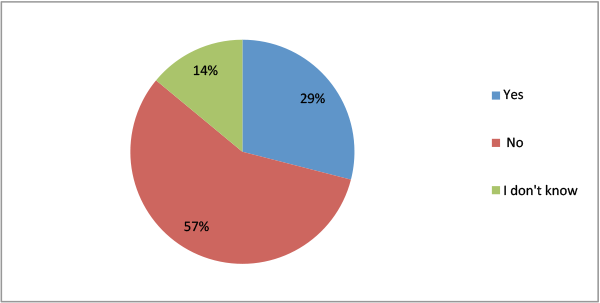

1. Were you satisfied with the funded-loan dollar volume that you were involved with during 2013?

- Yes

29% - No

57% - Don’t Know

14%

2. Were you satisfied with the number of funded clients that you were involved with during 2013?

- Yes

26% - No

61% - Don’t Know

13%

3. Were you satisfied with the ratio of funded loans as a percentage of loan applications that you were involved with during 2013 (loan/applicant ratio)?

- Yes

34% - No

54% - Don’t Know

12%

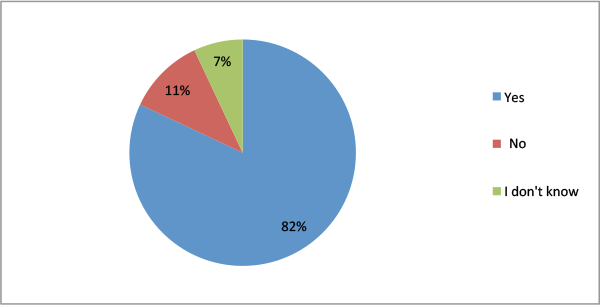

4. Do you expect to increase the funded-loan dollar volume that you will be involved with during 2014?

- Yes

82% - No

11% - Don’t Know

7%

5. Do you expect to increase the number of funded clients you will be involved with during 2014?

- Yes

81% - No

11% - Don’t Know

8%

6. Do you expect to increase the ratio of funded loans as a percentage of loan applications you will be involved with during 2014 (loan/applicant ratio)?

- Yes

64% - No

23% - Don’t Know

13%

7. Are you satisfied with the degree of property-value recovery achieved since 2009?

- Yes

51% - No

41% - Don’t Know

8%

8. Do you expect the U.S. economy to grow in 2014?

- Yes

64% - No

27% - Don’t Know

9%

9. Does your company plan to hire more people to facilitate CRE business loans in 2014?

- Yes

43% - No

34% - Don’t Know

23%

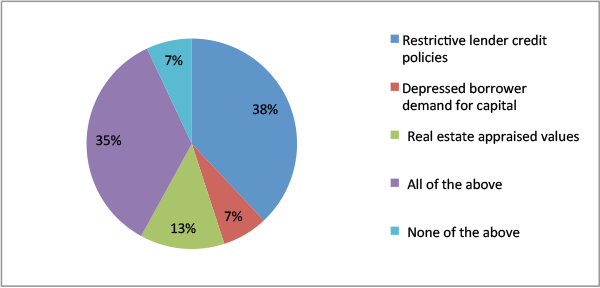

10. What do you expect will be the most significant barrier to funding CRE loans in 2014?

A. Restrictive lender credit policies – 38%

B. Depressed borrower demand for capital – 7%

C. Real estate appraised value – 13%

D. All of the above – 35%

E. None of the above – 7%