By Charles H. Green

According to economist Gregory Daco, the global growth outlook over the next five years seems to be moving sideways, “stuck in second gear,” as he put it. With contrasting results predicted for China, the Eurozone, and the other emerging markets, along with the effects of major structural changes occurring in China and Japan, there should be growth ahead, but he predicts it will be at a muted pace.

Daco is Head of U.S. Macroeconomics at the Oxford Economics, and spoke before an  audience gathered for the third quarter economic forecast presented by the Robinson College of Business at Georgia State University recently. He summarized the cloudy growth forecast in terms of the combination of mixed results from several of the world’s major economies:

audience gathered for the third quarter economic forecast presented by the Robinson College of Business at Georgia State University recently. He summarized the cloudy growth forecast in terms of the combination of mixed results from several of the world’s major economies:

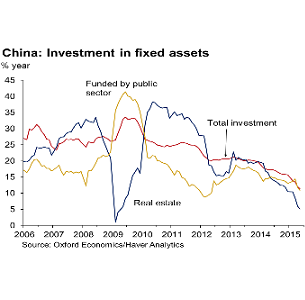

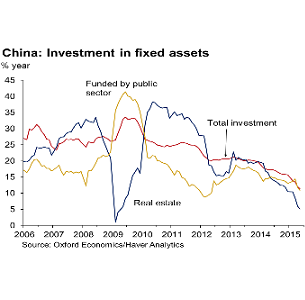

China–GDP results in China have been lower than expected, and as such, most economists have lowered forecasts, reckoning to a ‘new normal.’ Much of globe came to expect a continuation of the meteoric growth levels in the 10 to 12 percent range experienced in recent years, but that level has tapered off quickly without explanation. And given China’s tendency to obfuscate their intentions, there is global recognition that the economy is slowing down faster than the official numbers are described by the government.

Complicating matters is the fact that there are political transitions in play, with President Hu Jintao in the midst of purging the vast government of hundreds of senior and mid-level bureaucrats in an effort to root out corruption, all the while struggling with a slowing economy, which is not known as his strongest suit. There are emerging changes in upper mobility of Chinese consumers, who were encouraged to borrow for investments, only to watch the Shanghai composite index drop off precipitously in recent months.

After five years worth of building inventory and in the middle of a huge infrastructure building program, suddenly China’s commodity purchases has dramatically dropped off, leading to falling prices and activity. The question of not whether growth will slow, but how fast and how far?

So how are the other BRIC nations faring, in light of China’s stumble? There again, results are mixed, with two of the three suffering the hangover effects from Chinese gyrations.

Brazil-This emerging economy, darling of the late 2000s, hit the end of their super- growth rather abruptly. When China started buying up commodities in the 2000s, Brazil aimed an outsized portion of their output in response, and today is feeling the pain of those purchases going away. The commodity spikes are over, so production has slowed in response, unemployment has climbed back to high levels and there’s less capital available to support growth for anything else. Brazil is stuck with high debt levels, but their monetary policy is tough to effect any relief with a softening currency. A recession is forecast in 2016.

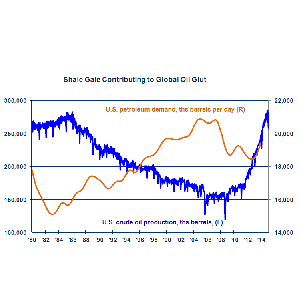

Russia –Despite a strong economy in recent years driven by the strong global demand for its oil and gas, Russia is not faring so well as oil prices have plummeted and the international economic sanctions over its invasion into Ukraine have begun to take a toll. Russia’s dependence on oil revenues has left it high and dry, as its currency has fallen off badly over the last year.

India-Of the BRIC countries, India is the bright spot at this time. Their emphasis on education development and investments are admirable for the long term potential for growth. Their more pro-business government is making key investments in transportation and food production, which have both brought prices down and given consumers more income. Prospects for this economy are looking positive.

Japan-Elsewhere, the world’s third largest economy is not projected to fare much better than recent years, but if there is a glimmer of positive news, they’re not projected to be heading into a recession, based on second quarter growth. Japan has an aging population, and although consumer confidence remains “ok,” wage growth has been flat or falling over the last several years, as workers have little bargaining power.

Industrial production growing is growing, but household spending is volatile. A 2014 planned tax hike cooled spending considerably last year, and after it went into effect, buying plunged. Inflation is hovering on deflation.

Europe-The big question for Europe is whether growth there, driven by considerable reductions in oil prices, is sustainable? Leading indicators suggests there is better growth ahead, and momentum is leaning toward solid gains in consumer growth and employment growth. Even consumer confidence is looking upward.

Will this be followed by corporate investments and profits? The Euro’s weakness tends to add inflationary pressure, meaning some consumers may postpone spending, and certainly lower spending on imports. Greece remains a risk, but is currently a much lower risk since the crisis has been deferred to work out down the road.

And where does the U.S. fit into this equation. Although we had a slow start to 2015, there was a stronger than expected 2nd quarter, particular in western states. Growth expectations remain strong for the balance of the year along with employment gains. The only question is when–not whether–the Federal Reserve will begin to normalize interest rates.

Did you know SBFI offers commercial lender training–learn more here.

Read more stories of interest to commercial lenders here.

What do you think about this story? Comment below or write me at .